3 lessons from Redcar Steelworks

The closure of a steelworks in Northern England has left a long mark on the local area

It is not a good time to be a steel worker in the UK. Liberty Steel, a steel conglomerate that employs 5,000 workers in the UK and 35,000 worldwide, appears to be on the verge of collapse. The main financier of Liberty Steel, Greensill Capital, filed for administration on 8th March 2021. It is not clear yet whether Liberty Steel will find alternative financial backing and stave off collapse.

The consequences if Liberty Steel did collapse would be severe in the short term. 1,600 workers in Yorkshire would be made unemployed and another 3,000 across other parts of Northern England and Wales.

Liberty Steel is just the latest in a long list of companies who have struggled to profitably produce steel in the UK. Six years ago, SSI Steel, owned by a Thai magnate, shut down its plant in Redcar, leaving 2,000 workers unemployed. The impacts of this loss are still being felt now and provide an indication of what might happen if Liberty Steel did shut down. Three lessons stand out:

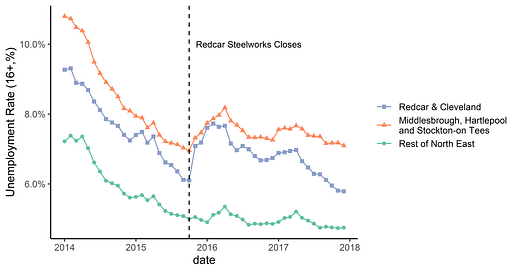

1) Unemployment remained high for two years after the plant shut down

Unemployment spiked in Redcar and Cleveland following the steel plant shutting down in September 2015. The alternative claimant count, a measure of unemployment, rose from 6% in September 2015 to 7% in November 2015. According to the SSI task force, a body set up by the Tees Valley mayor, 2,200 people filed for benefits due to the site closure. Unemployment also rose in three neighbouring areas: Middlesborough, Hartlepool and Stockton-on-Tees.

Only two years later in October 2017, did unemployment fall back to its previous levels. Government support played a role in bringing unemployment back down. The Tees Valley Combined Authority provided £50m of government funding, which was used to fund grants to local businesses and for training and jobs for affected works. This shows how persistent the effects of a big unemployment shock can be. Despite large scale support, it still took two years to bring unemployment back in check.

2) The closure hit older male workers hardest

Predictably, unemployment from the shock was highest in older male workers. Steel is a traditionally male industry and manufacturing workers are growing older in the UK. The average age of a manufacturing worker was 42 in 2019. As manufacturing has contracted, opportunities for younger workers to enter the profession have become limited and the jobs have become concentrated amongst experienced workers.

The challenge of reskilling and finding new employment is hardest for older workers. Decades of job-specific experience provide little use when applying for new roles. One ex-steel worker applied for 50 jobs before getting one. It is likely that some older workers chose to leave the labour force rather than start a new career.

There was also a smaller increase in unemployment amongst women and younger men. Those working at the plant will have been affected, but also people working in businesses whose custom depended either directly or indirectly on the steelworks.

3) The new jobs were different from the old ones

Although most people affected by the shock are now back in work, the type of jobs they are doing has changed. Manual jobs (such as those in the plant) fell from nearly 10% of employment in the affected areas in December 2014 to less than 8% in December 2016. Service jobs such as caring and leisure rose from 11% in December 2014 to 12% in December 2016. This reflects a broader shift in the UK away from manufacturing and to services, partially driven by increased globalisation. Redcar had previously been a bulwark against this trend.

The new jobs did not pay as well as the jobs in the steel site. There was an increase in the percentage of people employed in mid-skilled professional and technical occupations, which tend to pay better than manual jobs. However, average wages in the affected areas fell by 0.5% in real terms between 2015 and 2017, whereas in other areas of the North East average wages grew by 1.6% in real terms. While government support eased the immediate consequences of the steel site closure, it has permanently changed the economy of Redcar and the surrounding area.

There is no easy solution to the problems at Liberty Steel. Neither propping up a large conglomerate with government funding or letting it collapse are attractive options. The fate of Redcar after the SSI steel site shut down shows that if Liberty Steel does collapse, it will have large and lasting consequences.

Sources: ONS Claimant Count Data, DWP Alternative Claimant Count Data, Annual Survey of Hours and Earnings,

Notes: Unemployment rate refers to all those in unemployment claiming benefits, as a percentage of economically active population. I use the Alternative Claimant Count to adjust for differences in the speed of the Universal Credit roll-out between different areas.

There is uncertainty over the wage and sector figures as they are based on surveys with relatively small samples at local authority level.